Hi everyone! Since I hosted the Carnival of Money Stories last week, I’ll keep today’s link list on the short side. If you didn’t get a chance, be sure to read a few submissions. There were lots of great entries!

I also participated in three carnivals last week. First up, I threw my hat into the ring on the mammoth Carnival of Personal Finance at The Personal Financier. (Nice symmetry on the titles, eh?) I’ve been relying on NPR and the New York Times to understand last week’s crazy economic news. However, the Unreal Blog has another take on it all, complete with impressive graphics!

I love the Festival of Frugality for all the great tips, and this week’s edition at Living Almost Large was no exception. Thanks to Donna Freedman’s submission from the Smart Spending blog, I even found this great post on DIY cat litter. Hooray for Allie’s Answers! Yesterday, as I was changing the expensive stuff I buy, I was thinking there must be a better way. . .now I’ve got a couple of options!

Finally, I was in the Money Hacks Carnival at On a Quest to Be Debt Free. I like Miss Thrifty‘s tip to clean the oven. Pretty soon, I won’t be buying a single cleaning product!

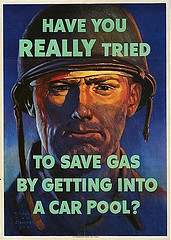

During my shopping bug this week, I also really appreciated Get Rich Slowly‘s post on advertising. If you haven’t subscribed before, be sure to check out this blog. This week, his wife posted a cool recipe for canned salsa. I prefer to just can the tomatoes and make the salsa from those when I want, but this looks mighty tasty!

Finally, I liked Simple Mom‘s frugal tips and the reminder that frugal tips are often eco-friendly tips. I think for most of us, frugal choices are important not just for the money they save but also for the impact they have on our environment!

Update: Yesterday, I posted about my sneaky shopping trigger. Well, last night, we went to Macy’s with a gift card. The husband found some great clothes, all on sale, for work meetings, but I came up empty-handed. It was a very disappointing trip, but I’m proud of myself for not buying something just to use up the card! I’m sticking by my plan to just buy quality items at good prices.

If you’ve never had a chance to read F. Scott Fitzgerald’s masterpiece, take the time now. In this slender novel, Fitzgerald captures all the longing and emptiness of an emerging consumer culture. I’ll never forget the scene where Gatsby flings shirt after shirt out of his closet to prove to Daisy that he’s finally made it.

If you’ve never had a chance to read F. Scott Fitzgerald’s masterpiece, take the time now. In this slender novel, Fitzgerald captures all the longing and emptiness of an emerging consumer culture. I’ll never forget the scene where Gatsby flings shirt after shirt out of his closet to prove to Daisy that he’s finally made it. Ralph Ellison’s critique of the American Dream is one of the most powerful of the twentieth century. His journey to understanding the racial dynamic of pre-Civil Rights America questions mainstream beliefs about the ability of anyone to get ahead.

Ralph Ellison’s critique of the American Dream is one of the most powerful of the twentieth century. His journey to understanding the racial dynamic of pre-Civil Rights America questions mainstream beliefs about the ability of anyone to get ahead.